Call or Text (720) 821-1820

The Harpers at Epique Realty

Real Estate Agents

SERVING THE FOLLOWING

LOCATIONS. LOCATIONS. LOCATIONS.

Boulder, Longmont, Niwot, Lafayette, Louisville, Superior, Loveland, Erie

and communities throughout Colorado's Front Range.

Epique Realty’s spectacular growth and success continue to be recognized, as the cloud-based brokerage.

We know it takes more than just a prime “location” to achieve top dollar for your home.

With 4x more transactions than the national average, we have developed proven strategies in the following areas:

property differentiation, market exposure, offer negotiation and operational execution.

to help you maximize profits on your largest investment.

The average real estate agent in the U.S. completes only three transactions per year. We are outperforming the national average by 10x and have a pulse on the local market that only comes with experience.

By harnessing the power of online media expertise, we are able to create greater demand, sell your home in record time for higher overall profits than other agents. With this expertise comes peace of mind that you are in the hands of true marketing experts.

To find out more about our proven techniques grab a copy of our book on Amazon or schedule a no obligation in home or virtual appointment:

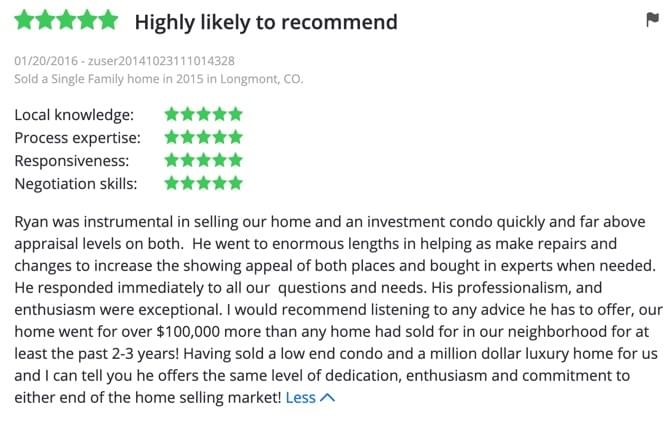

CLIENT TESTIMONIALS

ABOUT RYAN HARPER - Real Estate Agent

With a commitment to excellence at each phase of the real estate transaction process, the Harpers are currently within the top 5% of Realtors, real estate agents. They have a deep understanding of the local Boulder-area residential market and are setting a new bar for excellence in the real estate profession.

With the discipline of a U.S. Navy veteran, a light-hearted sense of humor and dedication to service, Ryan embodies passion, hard work and integrity.

Career Background

Before launching his career as a Realtor, Ryan worked in the building industry for over 11 years. He founded an electrical contracting company that grew to over $3 Million in sales. He then took his experience to the next level as a contractor of high-end custom homes. After selling this business, Ryan began to pursue another passion, internet marketing, and today is recognized by Google as an expert in the field. He co-authored one book, SEO and PPC Unleashed which is recognized as the “must read” for any business owner who wants to gain a deep understanding of online marketing. Ryan published a second book, Luxury Home Sales for the Digital Age which teaches his internet savvy to other Realtors looking to propel their businesses to new levels.

Differentiation

With his deep understanding of the home building process, coupled with his internet marketing savvy, Ryan provides expert advice throughout the property selection process and industry-leading sales techniques.

ABOUT SONDRA HARPER - Real Estate Agent

As co-founder of this powerhouse team, she quickly mastered the five phases of the real estate process and helped establish their reputation as one of the premier teams in Boulder County. When performing her role as a buyer’s agent, Sondra works closely with her clients, paying close attention to their every need. Finding the next perfect home for each client is her driving motivation and greatest area of accomplishment.

Career Background

Before launching her career as a Realtor, Sondra founded a Feng Shui consultancy. Through a rigorous standard of testing and evaluation, she achieved membership into the Feng Shui guild, as a Red Ribbon professional. Harmonizing one’s physical environment is a complex science and one that Sondra has embraced. Today she applies this knowledge to their home staging process to achieve the right energetic balance, increasing a property’s overall marketability and perceived value.

She is a passionate student, teacher and leader empowering those around her to live powerful, purposeful lives. She believes, (quote goes here).

She is actively involved in her community and is involved with many other professional affiliations.

Meet The Team

About John Vaughan- Real Estate Agent

Business Philosophy:

I’ve been helping my clients realize their real estate dreams for over 15 years. For most people, real estate transactions are one of the most important financial and emotional experiences in their life. The opportunity to participate in an event of such personal and financial importance is a privilege and a responsibility I take very seriously.

Over the years, I have learned that every real estate transaction is as unique as the people involved. In order to provide an exceptional real estate experience, I take the time to listen, learn and understand the unique needs, objectives and concerns of each client. I then commit all my

experience, knowledge and determination to provide my clients with a successful real estate transaction that exceeds their expectations.

Whether you are buying, selling, or investing in real estate, you deserve an experienced, knowledgeable, hard working real estate professional who values your time, your trust, and your business. Successful real estate transactions are a product of experience, hard work, attention to detail and an absolute commitment to exceptional results. It would be a privilege to provide you and the most important people in your life with a fantastic real estate experience! I offer a FREE, NO obligation consultation. Call me at 303-408-7420 to set an appointment. Living your dream is only a phone call away!

The market is moving very fast and it is critical that the real estate agent is very responsive. It is important for a great agent to be supported by expert staff who can respond within minutes, not hours. We are focused on providing the utmost responsiveness to our clients. In our business, speed is everything. It means the difference between buying the dream house or loosing the opportunity.

Q: What should sellers look for when hiring a Real Estate Agent?

1. Market exposure channels and marketing savvy

We spend our marketing budget where it counts. Over 92% of buyers use the internet so the majority of our marketing budget is spent on-line to attract the most buyers who are willing to pay top dollar. We ensure our homes are featured on the top internet sites: Zillow, Trulia, Realtor.com, Yahoo Homes, Facebook, Google and You Tube.

2. Affiliation with a large brokerage with a wide network. It is important to target other buyer specialists and keep your home top-of-mind for the co-op brokers and make your home stand out from all the MLS listings.

3. Proven repeatable system backed by market research.

We have a strategic approach gaining an 18% increase in sale price when compared to traditional real estate agents.

As active members, contributors and philanthropists, the Harpers are dedicated to living in abundance through abundant giving. Whether it’s being active participants in their local communities through professional, education and spiritual organizations, Ryan and Sondra strive to be the positive influencers on a local and global stage.

One of the organizations that the Harpers are passionately supporting is the Himalayan Institute. Sondra is a 200 hour Yoga Alliance Instructor and a student of Pandit Rajmani Tigunait of the Himalayan Institute.

ABOUT THE HIMALAYAN INSTITUTE

A leader in the field of yoga, meditation, spirituality, and holistic health, the Himalayan Institute is a non-profit, international organization dedicated to serving humanity through educational, spiritual, and humanitarian programs. The Institute and its varied activities and programs exemplify the spiritual heritage of mankind that unites East and West, spirituality and science, and ancient wisdom and modern technology. Learn more about Himalayan Institute

How to Avoid Capital Gains Tax When Selling Your Home

How to Avoid Capital Gains Tax When Selling Your Home

Selling your home can be both exciting and overwhelming, especially when it comes to understanding the tax implications. One big question that homeowners often face is whether they'll owe capital gains tax when they sell their property. Thankfully, many homeowners can avoid paying this tax, thanks to the Taxpayer Relief Act of 1997. Let's break it down in simple terms.

What is Capital Gains Tax?

Capital gains tax is a tax on the profit you make from selling a home (or any other asset) that has appreciated in value. The IRS considers your home a "capital asset," and if you sell it for more than what you originally paid (adjusted for any major improvements), you could owe tax on that profit.

Good News: Most Homeowners Are Exempt!

If you're selling your primary residence, there's a good chance you won't owe any capital gains tax. Why? Because the Taxpayer Relief Act of 1997 allows homeowners to exclude up to $250,000 of the profit from the sale of their home from taxes if they are single. If you're married and filing jointly, this exclusion doubles to $500,000.

Here are the main conditions to qualify for this exclusion:

You Must Have Lived in the Home for at Least 2 of the Last 5 Years

To qualify, the house must have been your primary residence for at least 24 months out of the last 5 years before the sale. The good news is that the 24 months don’t have to be consecutive!You Can Only Use This Exclusion Once Every Two Years

You’re allowed to use this exclusion only once every two years. So, if you’ve sold another home and used the capital gains exclusion within the past two years, you won’t qualify again until two years have passed.

How Much Capital Gains Tax Could You Owe?

Let’s assume you don’t qualify for the exclusion. How much tax would you owe?

If you’ve owned the home for less than a year, the profit would be considered short-term capital gains, and you'd be taxed at your regular income tax rate, which could be as high as 37%.

If you’ve owned the home for more than a year, your profit would be taxed as long-term capital gains, with rates ranging from 0% to 20%, depending on your income.

Special Considerations for Married Couples and Widowed Homeowners

Married couples can take advantage of the $500,000 exclusion if both spouses meet the residency requirement. However, if only one spouse meets the requirement, the exclusion drops to $250,000.

For widowed homeowners, there is a unique provision. If your spouse has passed away, you may still qualify for the $500,000 exclusion if you sell the home within two years of your spouse’s death and haven’t remarried.

What Records Should You Keep?

Keeping good records is essential, even if you qualify for the exclusion. Records help prove your cost basis, which is what you originally paid for the home plus any improvements (such as a new roof, remodels, or expansions). Here are some things to keep track of:

The purchase price of your home

Closing costs and fees you paid when buying the home

The cost of any major improvements you made while living there (new kitchen, roof, additions, etc.)

Selling expenses like agent commissions or advertising costs

Keeping these records ensures that if your profit exceeds the exclusion, you can reduce the taxable amount by adding these costs to your cost basis.

Converting a Rental Property to a Primary Residence

Did you know you can also exclude capital gains from a home that was previously a rental property? To qualify, you must have lived in the rental as your primary residence for at least 2 of the last 5 years. This is a great option if you're looking to move back into a rental property before selling it.

However, keep in mind that if you claimed depreciation deductions on the property while it was rented, you’ll have to recapture the depreciation and pay taxes on that amount when you sell.

How Can You Avoid Capital Gains Taxes?

Use the IRS Exclusion: If you qualify, the $250,000/$500,000 exclusion is the best way to avoid paying taxes on your home sale.

Increase Your Cost Basis: Keep track of home improvements and add those costs to your home's original purchase price, which helps reduce your taxable gains.

Offset Gains with Losses: If you have losses from other investments, they can offset the gains from selling your home.

Consider a 1031 Exchange: If you're selling an investment property, you can avoid taxes by rolling the proceeds into a similar property through a 1031 exchange.

Selling your home can be stressful, but understanding the rules around capital gains taxes can save you a lot of money. If you plan ahead and keep good records, you may never have to pay taxes on the sale of your home!

Sondra Harper

Real Estate Agent

Phone: (720) 821-1820

Ryan Harper

Real Estate Agent

Phone: (720) 821-1820

The Harpers at Epique Realty

1332 Linden Suite 3

Longmont CO 80501